Buying a home certainly requires plenty of work and often times a healthy dose of stress along with it. You’re going to have to put in the time and effort to buy a Delaware house you love, which makes it all worth it in the end for you and your family.

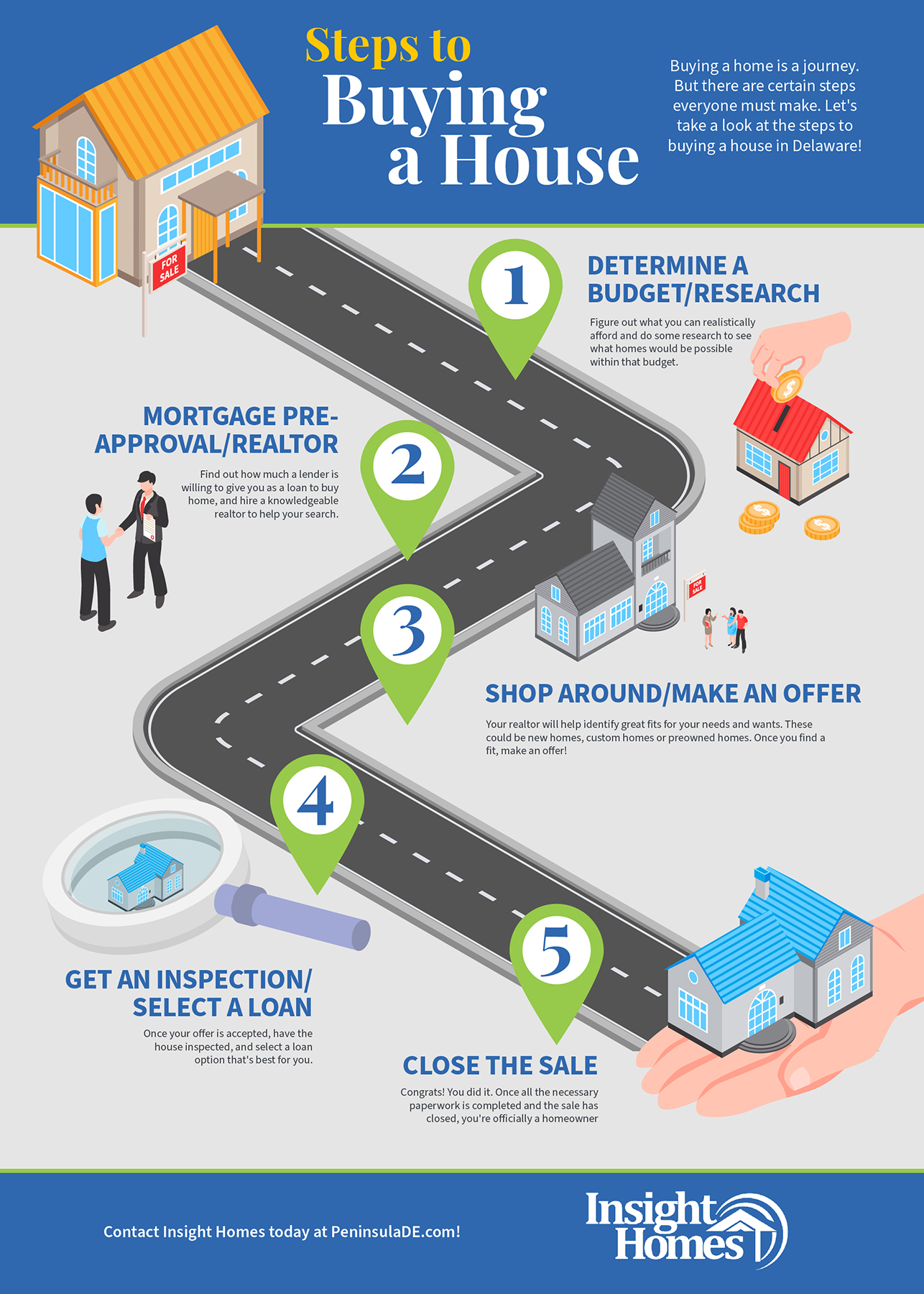

Today, The Peninsula On the Indian River Bay will take a look at buying a house in Millsboro, DE and fill you in on the 10 steps to buying a house. This will hopefully make the home-buying process manageable and aid you in making the best decision possible.

When it comes to new homes in Delaware, Insight Homes builds beautiful homes right here in this amazing, resort community. The Peninsula features an award-winning Jack Nicklaus-designed golf course and the most gorgeous setting in the state.

-

Determine A Budget

The first place you need to start when buying a house in Delaware is to determine just how much you can afford or at least what you’re willing to spend on your next home. The general rule of thumb is to shop for houses that are no more than three to five times your annual household income if you’re planning to put down the traditional 20 percent payment on the house and have a typical, moderate amount of other debt such as credit cards and car payments.

There are pretty good affordability calculators out there you can use to help you determine just how much you can afford. This can be done well in advance, especially if you’re still needing to save up the money to make a down payment on your next house.

-

Research

Once you’ve figured out how much you can reasonably afford to spend on your next home, it’s time to dig in and perform a little research. You want to determine where it is you want to live in Delaware, which can have a number of variables at play depending on your situation such as schools, proximity to your job and any other contributing factors. Finding Delaware homes online is the best way these days, but you can still check newspapers and magazines for real estate listings.

Make a list of homes you’re interested in buying, or new homes in Delaware that are similar, and take note of how quickly they are selling and for what price. This will give you a sense of how long the buying process will take and what type of offer will be competitive in your area of interest.

-

Get Preapproved for Your Mortgage

Now that you’ve put together a budget for your next home and did the necessary research to see where it is you want to live and what offer you should make (and home long it could take to close), you’re ready for more serious steps. The first critical piece when buying a home is to see how much a mortgage lender will give you. The best way to do this is by getting prequalified for a mortgage.

A lender will ask for relevant information such as household income and savings or investments you have, then review the info and come back to you with how much they will lend you. This will then give you a price range of homes to seriously shop around for. Later on, you’ll actually get preapproved credit, which requires actual documentation such as W-2 statements, paycheck stubs, bank account statements and so on. They will use this info to verify your financial status and credit.

-

Find A Strong Realtor

Real estate agents are important partners when buying a house (or selling a home) because they provide you with helpful information on homes and neighborhoods that is otherwise difficult to find on your own. Realtors also have a strong understanding of Delaware real estate, which is to your benefit. They can also look for homes in your price range and particular requirements to assist in finding your perfect house. Their knowledge, negotiating skills and familiarity are all incredibly useful to you as a home buyer. Realtors are compensated from the commission paid by the seller of the house, so there’s no reason not to use one.

-

Shop and Make An Offer

Go around and tour homes for sale in Delaware that are interesting to you and fit your price range. Taking notes (and photos) is a good idea because the different aspects of each house can blend together if you see enough of them. Some things to look for when touring open houses are:

- Test the plumbing by running the shower to see the water pressure and how long it takes for hot water

- Try the electrical system by turning on and off lights

- Open and close windows and doors to make sure they work correctly

- Check to see if the neighborhood seems nice, safe and well-maintained

- Notice how much traffic the street gets

- Look to make sure there is enough parking

Ideally, you take as much time as you need to find a house that actually meets or even exceeds your requirements and budget. Once you and your realtor have found the perfect house, then you’re ready to make an offer, which the real estate agent again will be a nice resource for.

Consult with them on what a competitive offer looks like and use your best judgment. The key is to balance being competitive without overpaying. Alternatively, you don’t want to lose the house to a better offer by coming in unreasonably low.

-

Get An Inspection

Most offers are contingent on the house passing an inspection of the property, where they look for signs of structural damage or other issues. Your realtor generally helps set this up within a few days of your offer being accepted by the seller. This period protects you from buying a house that has serious complications you couldn’t see before and potentially opens the door for renegotiation or to pull the offer completely if the inspection yields evidence of significant damage.

-

Select Your Loan

Assuming the inspection goes without issue and the offer stands, you work with a mortgage lender to acquire a loan on the purchase of the new house. There is a wide range of competitively-priced loans and customer service, so choose one that you’re comfortable with. Again, our program connects you with proven mortgage brokers and the choice of who you use is completely up to you alone, although, we do provide a coordinator to assist and suggest options for you in an effort to ensure your satisfaction with the entire process.

It’s up to you to decide what kind of mortgage best fits your situation. Some people prefer shorter terms with higher monthly payments to keep the interest lower and some rather pay less per month and extend the loan over a longer period of time. Both are great options and totally depend on what’s most important to you and your family.

-

Have the House Appraised

Lenders arrange to have your new house independently appraised to get an estimate of the value of the home you’re buying. The appraiser is a third party and is not directly associated with the lender. The appraiser then lets all parties know that you’re paying a fair price for the house.

-

Coordinate the Paperwork

Because Delaware new homes are expensive compared to other things you purchase in life, they require lots of legal documentation and there is plenty of paperwork to fill out when buying a house. Your lender arranges for a title company to handle the paperwork (again, our program partners with great title companies!) to ensure everything is completed properly and verify that the seller is indeed the rightful owner of the house they’re selling.

-

Close the Sale

Congrats! At this point, you’re at the end. You will sign all the paperwork required when buying your new Delaware house, including loan documents. This can take a couple of days so the loan can be funded after the paperwork comes back to the lender. Once the check is delivered to the seller, you’ve done it! You can move into your new house.

Contact Insight Homes Today

Contact Insight Homes Today

When it comes to purchasing new homes in Delaware, there isn’t a finer resort-style, private community in the entire state or region than The Peninsula on the Indian River Bay. Better yet, Insight Homes is among the best home builders in Delaware. Every Insight home is built with only the highest quality, which allows you to live a life of luxury and experience everything the Peninsula has to offer each summer or year-round! To learn more, don’t hesitate to contact Insight Homes today.